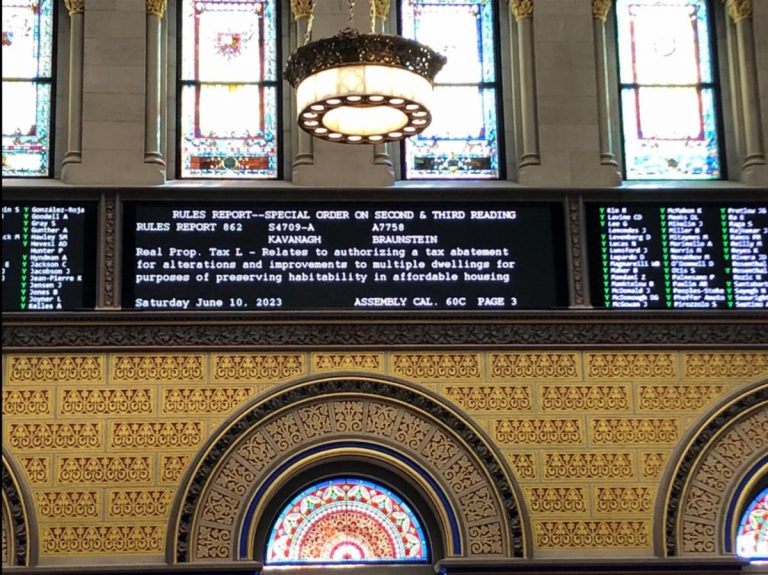

The PCCC is happy to report that on the morning of June 10, 2023, the J51 tax abatement/exemption law(one of our signature issues in this session), which creates tax abatements/exemptions on capital improvement work was extended for two year period. Both the State Senate and Assembly approved the extension and now requires the Governor’s signature.

The President’s Co-op & Condo Council (PCCC) has been advocating for its’ renewal for the past two years. NYS Assemblyman Ed Braunstein and Senator Toby Stavisky introduced legislation to reinstate the J-51 Tax credit retroactively from June 2022. The old bill’s assessed valuation (AV) for eligibility was $34,637, but the new bill raised the AV to $45,000, making many more of our Members eligible for J51 benefits once again.

We would like to thank both Assembly Member Braunstein and State Senator Stavisky for their dogged advocacy for the passage of this bill and numerous bills on behalf of Co-op/Condo homeowners over the years. In addition, we would also want to acknowledge State Senators Kavanaugh and Salazar for their roles in pushing this bill in the State Senate. We can all agree that this bill, which targets the valuable middle/working class housing stock in New York City, will provide a benefit for the entire City.

We will keep you posted on any new developments on this issue, including when and if the Governor signs it.

Link to Bill: